A Yield curve shows the yields of bonds with different maturities. Yield refers to the return on bond investments. The yield curve's normal shape is upward-sloping. Short-term yields (yields on short-term bonds) are generally lower than long-term yields. Sometimes, however, the yield curve can become inverted. Short-term yields can be higher than long-term yields. This is called yield curve inversion. Although it is rare, yield curve inversion does occur from time to time.

Understanding Inverted Yield Curves

The yield curve graphically shows yields on similar bonds over various maturities. The term structure for interest rates also knows it. The U.S. Treasury daily publishes Treasury bonds and Treasury bill yields, which can be charted in a curve. Analysts often use yield curve signals to indicate a spread between maturities. This simplifies the process of understanding a yield curve that has an inversion between different maturities. However, there is no consensus on which spread is the best indicator of recession. The yield curve tends to slope upward because holders of longer-term debt take on more risk.

Inversions in yield curves occur when long-term interest rates fall below short-term rates. This is because investors expect short-term rates to decline in the future, usually due to impaired economic performance. In modern times, such an inversion has been a reliable indicator of recession. Inversions of yield curves are rare, but they often precede recessions. They, therefore, draw intense scrutiny from participants in financial markets.

Select Your Spread

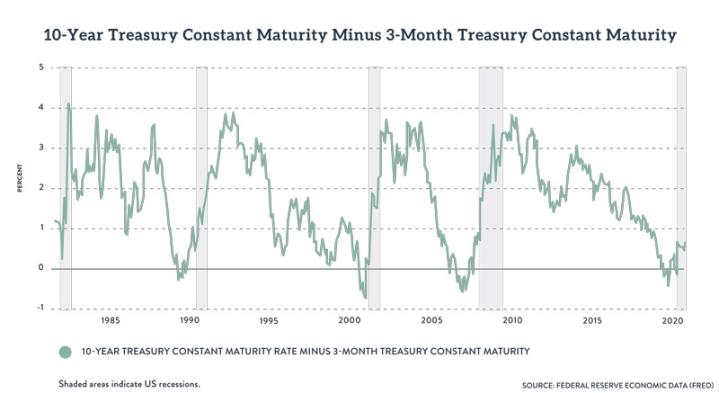

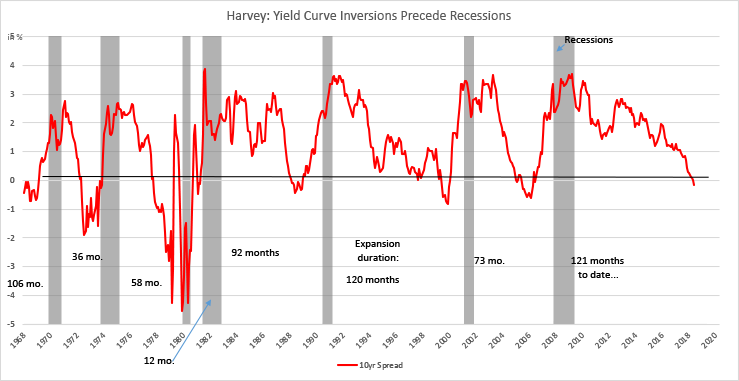

Inverted yield curves and recessions are often studied by academics who focus on the spread between yields on the U.S. Treasury bonds (10-year) and three-month Treasury bills (3-month Treasury bills). Market participants, however, have focused more on the spread between yields on 10-year and 2-year bonds. Federal Reserve Chair Jerome Powell stated in March 2022 that he prefers to measure recession risk using the difference between the current three-month Treasury bill rate and market pricing of derivatives projecting the same rate 18 months later.

Examples

Since the mid-1960s, the 10-year Treasury spread has been a reliable indicator of recession. However, this has not stopped many senior U.S. economists from discounting its predictive power over the years. After the Russian debt default, 1998 saw the spread of the 10-year/2 year briefly invert. The Federal Reserve quickly cut interest rates to avoid a U.S. depression.

The spread was inverted during 2006 for a large part of the year. In 2007, long-term Treasury bonds outperformed stocks. The Great Recession started in December 2007. The 10-year/2-year spread briefly fell to 0 on Aug. 28, 2019. Due to the COVID-19 pandemic that erupted six months earlier, the U.S. economy experienced a two-month recession between February 2019 and March 2020.

Yield Curves and Interest Rates

It is common for interest rates on shorter terms to be lower than those on longer terms. As a result, the yield curve slopes upwards to represent the greater yields associated with investments held for longer periods. This kind of yield curve is referred to as the typical yield curve. The yield curve gets flattered when there is less of a difference in interest rate between short-term and long-term investments. Investors often see a flat yield curve when a normal yield curve transforms into an inverted one.

Formation

Investors purchase long Treasury bonds as they are perceived as a haven from falling equity markets and capital preservation. They also offer the possibility of appreciation as interest rates fall. Inverted yield curves are formed when short-term rates fall because of the rotation to longer maturities. Inversions have caused equity prices to peak six times since 1955. The economy then went into recession in seven to 24 months.

In August 2006, an inverted yield curve was created by the Fed's short-term interest rate increases in response to mortgage and equity markets overheating. The peak of Standard & Poor's 500 in October 2007 was preceded by 14 months, and the official beginning of the recession in December 2007 was 16 months.

The yield curve inverted again in 2019, causing concern among economists for a new downturn. The COVID-19 pandemic in early 2020 did indeed trigger a global recession. However, economists do not believe the yield curve could have predicted the pandemic. The COVID-19 recession did not last long and quickly recovered to record levels in 2022. The yield curve's shape remained volatile, with some forecasting an inverted curve in 2022.

The current business cycle is expected to continue with a slowing economy. History has shown this. There is a high chance that investors will see long-dated Treasuries purchase as the best option for their portfolios if they are concerned about the next recession.